nc state sales tax on food

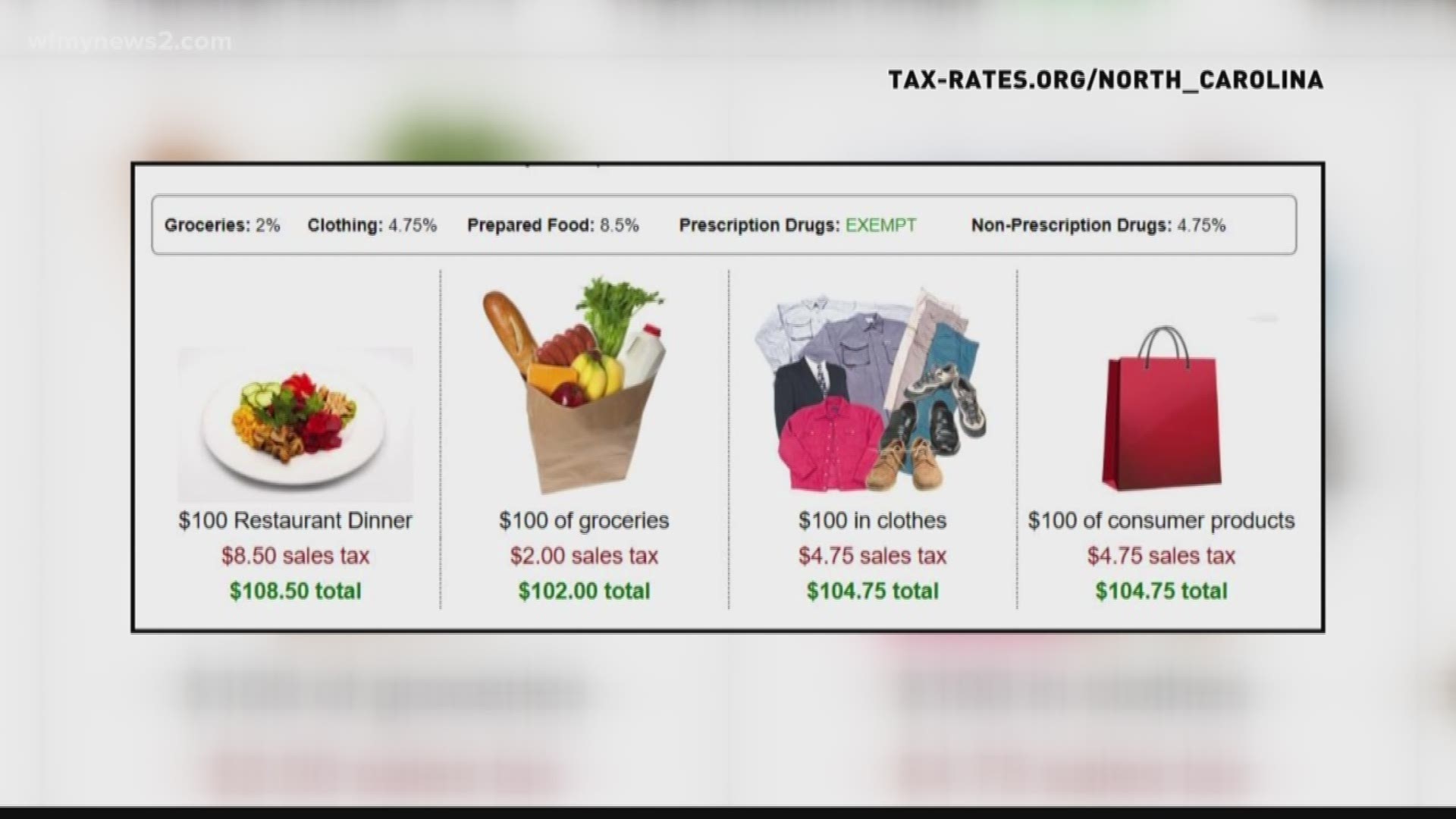

The Tax Foundation is often asked which states exempt certain items from their general sales taxes especially as they relate to food. But North Carolina does charge the 2 or 225 percent local sales tax on qualifying food exempting food purchases only from the statewide sales tax and the transit tax.

North Carolina Sales Tax Rates By City County 2022

Both the charge for the dining plan and the tax surcharge will be listed separately on students bursar bills.

. 92 out of the 100 counties in North Carolina collect a local surtax of 2. Of the states with sales taxes. North Carolina sales tax rates vary depending on which county and city youre in which can make finding the.

The minimum combined 2022 sales tax rate for Asheville North Carolina is. You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin. This page describes the taxability of food and meals in North Carolina including catering and grocery food.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Select the North Carolina city from the. With local taxes the total sales tax rate is between 6750 and 7500.

Find your North Carolina combined state and local tax rate. A Three states levy mandatory statewide local add-on sales taxes at the state level. Did South Dakota v.

Our creditbank card processor will be adding a 275 managed convenience fee for all card transactions. Sales Tax Breakdown. The base state sales tax rate in North Carolina is 475.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. The funds for the meal plan and the NC Sales Tax Surcharge are added to the students DukeCard food point account. North Carolina has recent rate changes Fri Jan 01 2021.

North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. 31 rows The state sales tax rate in North Carolina is 4750. Those rates are included in our calculation of the state general sales tax rate and the grocery rate where applicable.

NCDOR Taxes Forms Sales and Use Tax. This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that serve food. The County sales tax rate is.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. When calculating the sales tax for this purchase Steve applies the 475 tax rate for North Carolina plus 2 for Wake Countys tax rate and.

Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Carolina local counties cities and special taxation districts. Sales and Use Tax NCDOR.

To learn more see a full list of taxable and tax-exempt items in North Carolina. South Carolina is the state that most recently eliminated its sales tax on food effective November 1 2007. Appointments are recommended and walk-ins are first come first serve.

Student dining plans are now being taxed at the combined state and Durham county rate of 75. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. The Asheville sales tax rate is.

The North Carolina sales tax rate is currently. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Seven states tax groceries at lower rates than other goods.

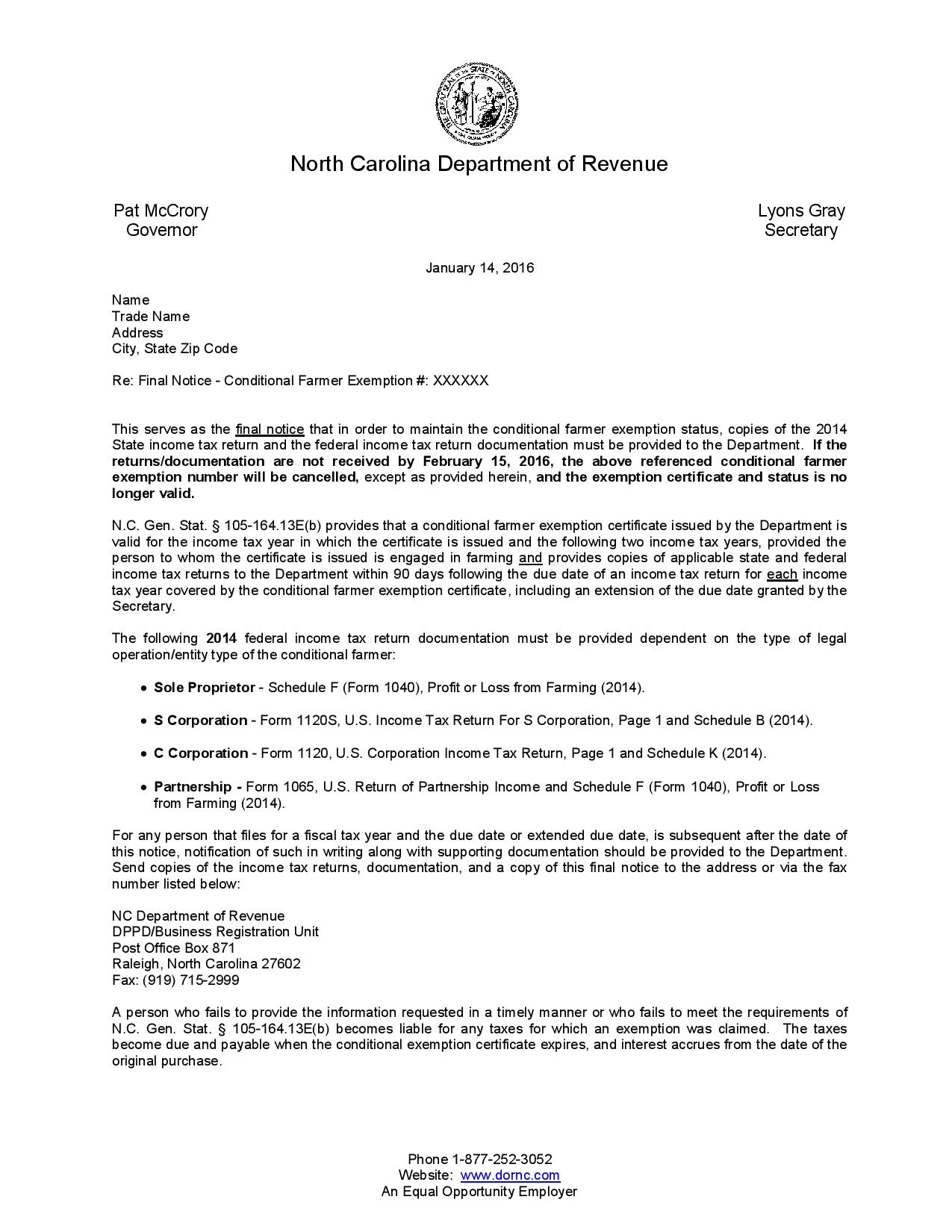

It is the time of year when many farmers markets across the state are re-opening for the season. The transit and other local rates do not apply to qualifying food. Sales Use Tax Effective March 1 2021 State Surplus sales are subject to sales use tax as determined by NC Dept of Revenue.

At a total sales tax rate of 675 the total cost is 37363 2363 sales tax. They are Arkansas. Thirty-one states and the District of Columbia exempt most food purchased for consumption at home from the state sales tax.

Make Your Money Work A number of categories of goods also have different sales tax rates. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. California 125 Utah 125 and Virginia 1.

This is the total of state county and city sales tax rates. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. The NC Department of Revenue has a a presentation available.

North carolina 475 4 north dakota 5 ohio 575 oklahoma 45 oregon none -- -- --pennsylvania 6 rhode island 7 south carolina 6 south dakota 45 tennessee 7 4 4 texas 625 utah 61 5 30 5 vermont 6 virginia 53 2 25 2 washington 65 west virginia 6 wisconsin 5 wyoming 4 dist. The following is a list of the states that do tax groceries and if applicable which ones apply a special rate on grocery items. Sales Tax On Grocery Items Taxjar.

Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. What is the sales tax rate in Asheville North Carolina. With that many market managers get questions from farmers about sales tax requirements and other related taxes and may also have questions about the markets documentation requirements.

Walk-ins and appointment information. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy.

States With Highest And Lowest Sales Tax Rates

Thanksgiving Brunch At Blue Restaurant Bar Uptown Charlotte Nc Fresh Cranberry Sauce Brunch Restaurants Thanksgiving Brunch

Is Food Taxable In North Carolina Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Home Depot Sales Tax On Tool Rental Home Depot Sales Home Tools Rental

Ncsu Painted Cooler Ncstate Ourstate Wolfpack Nc State Nc State Wolfpack Wolf Pack

Sales Tax On Grocery Items Taxjar

Is Food Taxable In North Carolina Taxjar

Gameday Ncsu Women S Boot Ncs L052 1 Womens Boots Boots Gameday Boots

North Carolina Sales Tax Small Business Guide Truic

Top Income Tax Rate In The U S By State For Tax Year 2013 Income Tax Map Income

States Without Sales Tax Article

Is Food Taxable In North Carolina Taxjar